Weekly technical Analysis for week ended

30th May 2014

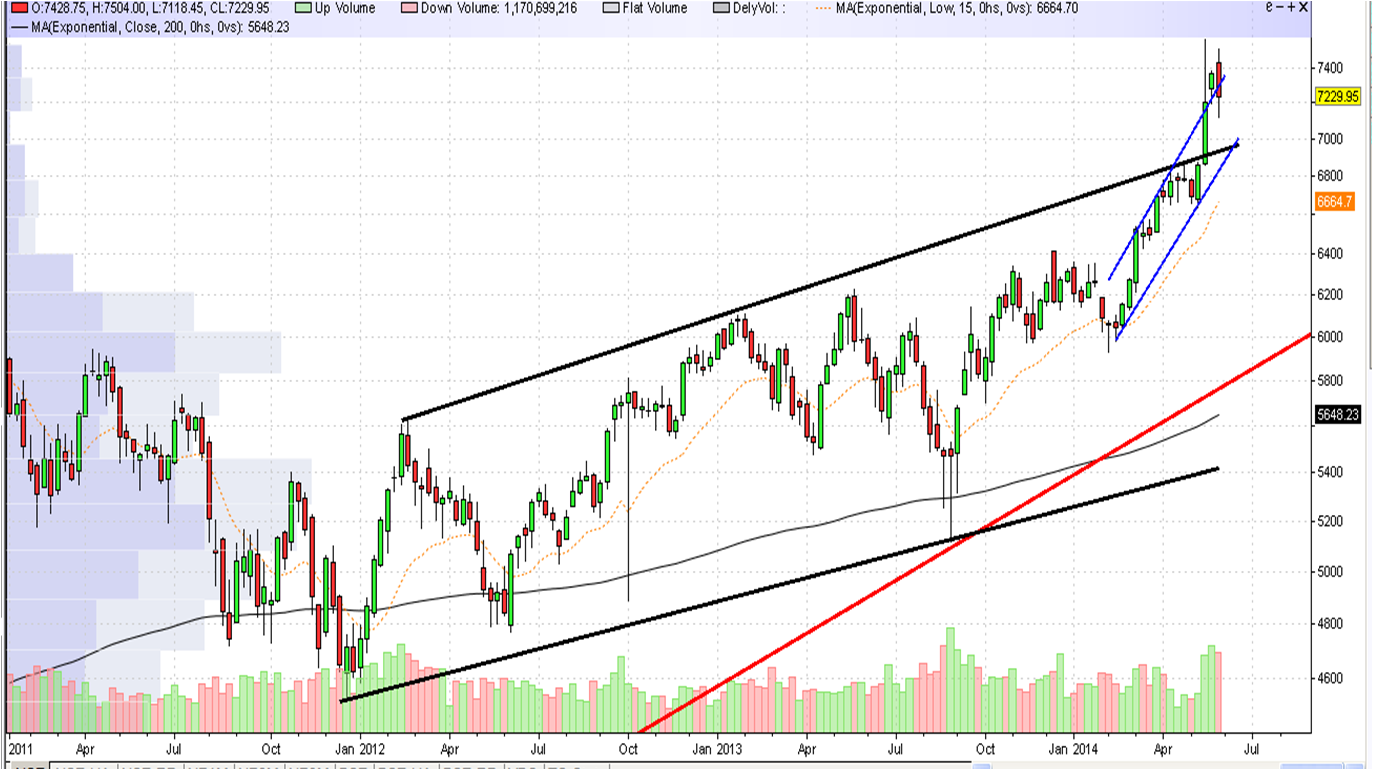

Nifty during the week opened on a high note moved up

and made a high of 7428 on Monday and there after started to move down and all

during the week the market was forming only red candles and moving down and it

made a low of 7118 and finally closed at 7229. Whole during the week the market

was in the range of the 16th may opening candle only. During the

last two week the market was in the range of the opening candle of 16th

May (election result day) and on Friday it moved below the low of the 16th

may candle. The movement in the range of the candle is indicating the there is

some amount of selling coming into the market in short term as at every rise

selling is coming. The long tail on 16th itself is indication the

heavy selling has gone into it and it would require an fair amount of buying to

move above the high of 16th of may. This week the market has touched

20 day EMA and the moved up this has happened 3rd time during the

last three months. Every time it touched or moved below heavy buying has come. So

we have to see whether we move below the low of 16th may or not. Any

close below the low of 16th may candle is an indication of weakness

and we can see market moving further down as it would signal the movement of

market below 20 day EMA. So we have to keep a close watch on market this week. Also

we have RBI credit policy this week which would give the idea about the new governments

view. The budget is going to be presented in second week of july, so whether

the market would correct till then and then move up only we can speculate. Governments

view and policies would be out only in budget, So FIIs should be waiting on

side lines till that time. And they would jump in if the budget focuses on

growth so we have to wait for budget to complete to see for a major move. My

view is that we might not make a new high till the budget. But as I say price

is the king.

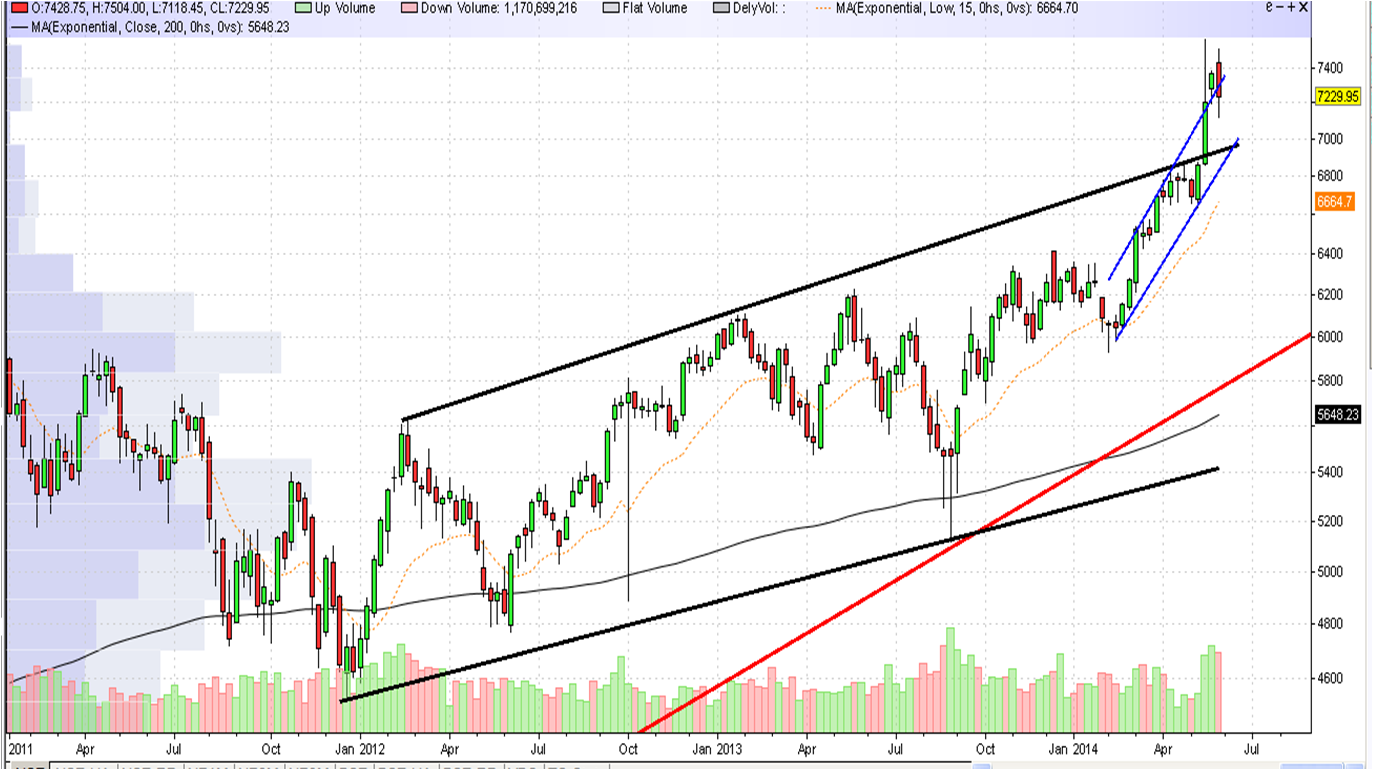

Above the chart of the nifty for last 2 years, it

can be noted that the nifty has broke the trend line of last two years in the

month of may and move up and made a new high. But generally when the long term

trend line is taken out the market move up comes down takes support/breaks the

trend line and then starts to move up and that would be the genuine move or a

perfect technical set up. If this is being set up then we can expect the market

to move below 7000 towards 6900 levels and then start an up move which can take

it to a new high. We have to see the same.

The important event would be when the market takes support or breaks the

trend line on down wards. So that event has to be watched with utmost care.

M.MahidaRSri

Trend is

Friend

Enjoying Life